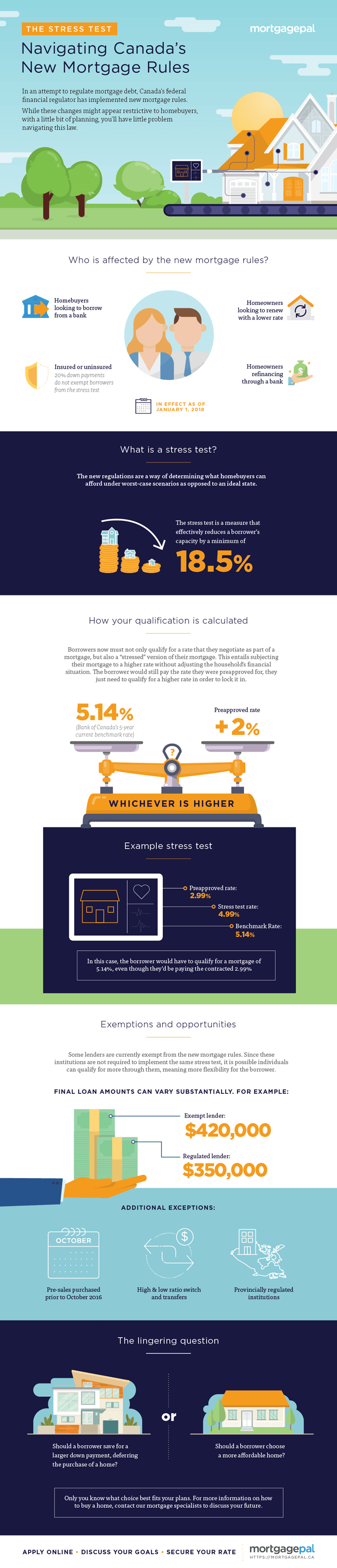

The Office of the Superintendent of Financial Institutions (OSFI) has been a popular topic of discussion around dinner tables these days. Everyone is talking about the new B-20 mortgage rules that came into effect January 1, 2018. Although these mortgage rules were highly anticipated, there’s still some confusion out there, especially for those renewing their mortgage.

In this post, we’ll take a closer look at the mortgage stress test and who is impacted.

Are you putting down 20 percent?

Are you a homebuyer making at least a 20 percent down payment who’s buying after January 1st? Then you’re affected by the new mortgage rules. All things considered equal, you’d find it easier to qualify before January 1st.

Let’s say since interest rates are rising, you’re planning to choose a five-year fixed rate mortgage. Under the old mortgage rules, you’d only have to qualify at your mortgage rate at your lender. So, if your mortgage rate is 3.15 percent, then that’s the rate you’d qualify at. Simple enough.

However, under the new mortgage stress test rules, you must pass a more onerous stress test. Now you’ll need to pass a higher hurdle: the greater of your mortgage rate plus two percentage points and the Bank of Canada’s five-year benchmark rate. In the above example, if the Bank of Canada’s five-year benchmark rate is 4.99 percent, then you’d have to qualify at 5.15 percent, since it’s the higher of the two.

Why the banking regular introduced the B-20 stress test

You’re probably wondering why Canada’s banking regular OSFI brought in the mortgage stress test. We’ve seen a lot of changes in the housing market in the last 16 months, including Ontario’s Fair Housing Plan, higher mortgage rates and B.C.’s 30-point plan for housing affordability.

The main reason for introducing the stress test is because Canadians are carrying a lot of debt. OSFI wants you to prove you can handle higher mortgage rates when they arrive in the future. Although qualifying at a mortgage rate two percentage points higher is pretty onerous, those are the new rules, so you’ll have to live with them.

The government and banking regulators just need to be careful about introducing too many housing market changes within a short period of time, as housing is a major driver of economic growth. Slowing down the housing market could weigh on the GDP numbers in the coming months.

This handy infographic might help to clarify things:

[infographic heading=”Share this Image On Your Site” site=”Mortgage Pal” siteurl=”https://mortgagepal.ca” imageurl=”https://mortgagepal.ca/wp-content/uploads/2018/04/B-20-Rule-Changes-MortgagePal.png” imagealt=”B-20 Rule Changes” url=”https://mortgagepal.ca/b-20/” boxwidth=”540″ boxheight=”100″ imagewidth=”700″]

How do the new mortgage rules impact my buying power?

If you’re planning to buy a home in the near future, you’re probably curious about how the mortgage stress test rules affect you. Under the new mortgage rules, homebuyers on average lose about 20 percent of their purchase power. For example, if you qualified to spend $500K on a home under the old rules, you’d only be able to spend about $400K under the new rules.

If you’re purchasing a home in place with lower home prices like Saskatoon or Charlottetown, you probably won’t feel much impact from the new mortgage rules since most homebuyer don’t stretch themselves financially there. However, if you’re buying in more expensive real estate markets like Toronto and Vancouver where every dollar counts, you’ll certainly feel the pinch. You may be forced to move a rung down the property ladder.

Under the old mortgage rules you could have afforded a detached home, but under the new rules you may only be able to afford a townhouse or condo. Another option is to buy a home further outside the city where your home-buying dollars typically stretch further. Both may not be ideal, but you’ll have to make sacrifices under the new mortgage rules if you want to make your home buying dreams to become a reality.

Will the stress test slow down the real estate market?

Based on housing market statistics, it seems many homebuyers rushed into the housing market towards the tail end of 2017 to avoid the new mortgage rules. So far it’s been a slow start for the housing market in 2018.

The spring housing market will be the real litmus test. Will we see homebuyers return in droves or continue to sit on the sidelines? I find that it takes at least three to six months for a major mortgage rule change to work its way through the system. With this being an especially big one, expect it to weigh on home prices for at least the first half of 2018, especially in Canada’s most expensive markets, Toronto and Vancouver.

Other things you need to know about the stress test

Here are some other things to know about the stress test.

Only federally regulated lenders are required to stress test your mortgage. That means credit unions, which are provincially regulated, don’t need to impose the stress test. If you’re having trouble qualifying for the mortgage size you had hoped, it might be worth exploring credit unions. (Although who knows how long until credit unions are forced to adopt a similar stress test.)

Homebuyers aren’t the only ones impacted by the stress test. Is your mortgage coming up for renewal in 2018? If you’re hoping to shop around for a mortgage, you’ll need to pass the stress test if you switch lenders. Your lender is well aware of this, so don’t expect to get the best mortgage rate upon renewal. How the mortgage stress test impacts you depends on how much equity you’ve built up in your home. It’d be prudent to give your mortgage broker a phone call to crunch some numbers to see how it affects you.

Looking to refinance your mortgage? Again, you’re affected by the mortgage stress test. Reasons you might want to refinance include consolidating debt or borrowing from the equity in your home for a major renovation. If your debt ratios are already near the maximum, you might have a difficult time refinancing under the new rules. Again, speak with your mortgage broker.

Even if you have a 20 percent down payment, you might consider only putting 19 percent down on a home you’re buying. Here’s why. Not only can you avoid the strict new mortgage stress test, mortgage rates tend to be lower on CMHC insured mortgages. Again, speak with your mortgage broker and crunch some numbers to see if putting down less than 20 percent makes sense.